Mastering the intricacies of gains and deficits, often represented as PNL, is essential for any aspiring trader seeking consistent performance. PNL provides a clear view of your {tradingstrategy’s effectiveness over time. By meticulously analyzing your PNL, you can pinpoint areas for improvement, fine-tune your strategies, and ultimately maximize your trading outcomes.

- A in-depth understanding of PNL enables traders to make informed decisions based on real data rather than instinct.

- By monitoring your PNL, you can quantify the impact of different trading styles and establish which ones are generating the highest gains.

Ultimately, PNL acts as a essential tool for traders to evaluate their progress, reduce risk, and aim for consistent profitability in the dynamic world of trading.

Leveraging PNL Analysis to Optimize Portfolio Performance

Achieving peak portfolio performance necessitates a thorough understanding of your investment strategy's effectiveness. PNL analysis, short for Profit and Loss analysis, provides invaluable knowledge into the trajectory of your investments. By rigorously analyzing past PNL movements, you can pinpoint areas where your portfolio surpasses expectations and reveals potential shortcomings. This strategic approach empowers you to make intelligent adjustments, streamlining your portfolio for long-term growth.

Profit & Loss Statement Analysis: Core Factors Driving Portfolio Decisions

When crafting an effective investment strategy, scrutinizing the core metrics within a Profit & Loss (PNL) statement is paramount. This metrics provide invaluable insights into the performance of specific investments and the overall portfolio health. Key PNL metrics encompass such factors as gross/net profit, returns on investment (ROI), risk-adjusted returns, and drawdown. Understanding these metrics allows investors to recognize profitable trends, mitigate potential losses, and make informed decisions about future investments.

- Observing PNL metrics frequently enables investors to assess the effectiveness of their current strategy and implement crucial modifications as market conditions evolve.

- Furthermore a comprehensive understanding of these metrics may help investors distribute capital more efficiently across different asset classes to optimize portfolio returns.

Ultimately, PNL analysis serves as a crucial tool for investors to steer the complexities of financial markets and attain their investment objectives.

Reducing Drawdowns with PNL Strategies

Effectively controlling drawdowns is a key objective for any astute investor. PNL management offer a powerful framework to achieve this goal. By utilizing sound PNL practices, investors can limit the severity and frequency of downward market movements on their portfolios.

A crucial aspect of PNL management involves setting clear risk tolerances. This provides a guideline for determining appropriate position sizes and modifications based on market circumstances.

- Furthermore, disciplined monitoring of PNL is essential. Portfolio managers should continuously scrutinize their PNL performance, pinpointing any indications that may warrant corrective actions.

- Leveraging advanced platforms can also optimize PNL management. These technologies often provide real-time data and analytical capabilities, enabling portfolio managers to make more strategic decisions.

The Role in Driving Positive PNL

Effective risk management is a vital component in achieving positive profit and loss results. By strategically identifying, assessing, and mitigating potential challenges, businesses can reduce their exposure to negative situations. This allows them to devote resources to opportunities for more info growth and profitability. A robust risk management strategy helps ensure that decisions are data-driven, leading to more successful financial performance. Ultimately, by embracing a culture of risk management, organizations can optimize their chances of achieving sustainable positive PNL.

Discovering Profit Potential with Strategic PNL Tracking

In today's volatile business landscape, accurately monitoring your Profit and Loss (PNL) is crucial for sustainable growth. Strategic PNL tracking allows you to gain invaluable insights into your financial standing, enabling data-driven decisions that enhance profitability. By implementing robust tracking tools, you can reveal areas of strength and mitigate potential weaknesses.

A clear understanding of your PNL allows you to forecast future trends with greater accuracy, enabling informed approaches for expansion.

Through meticulous PNL tracking, you can unlock the full profit potential of your business.

Neve Campbell Then & Now!

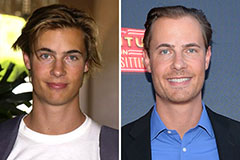

Neve Campbell Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!